40+ should you make extra mortgage payments

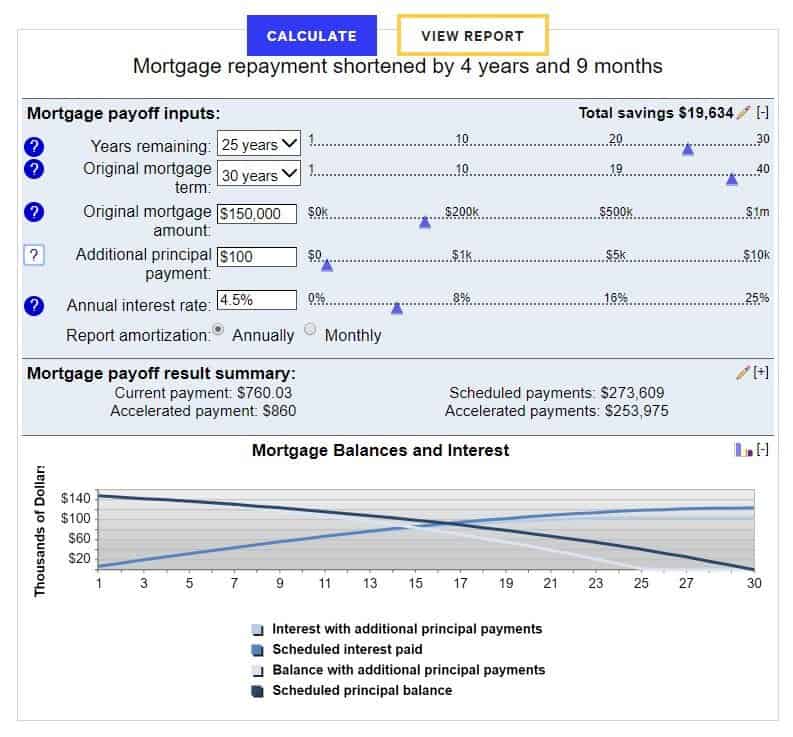

Web Making extra payments will save you 37069 in interest. However if you pay an extra 100 per month youd save roughly 28000 in interest costs.

How To Beat The Bank Make An Extra Mortgage Payment Choice Home Mortgage Elite Capital Solutions

Web Four alternatives to paying extra mortgage principal.

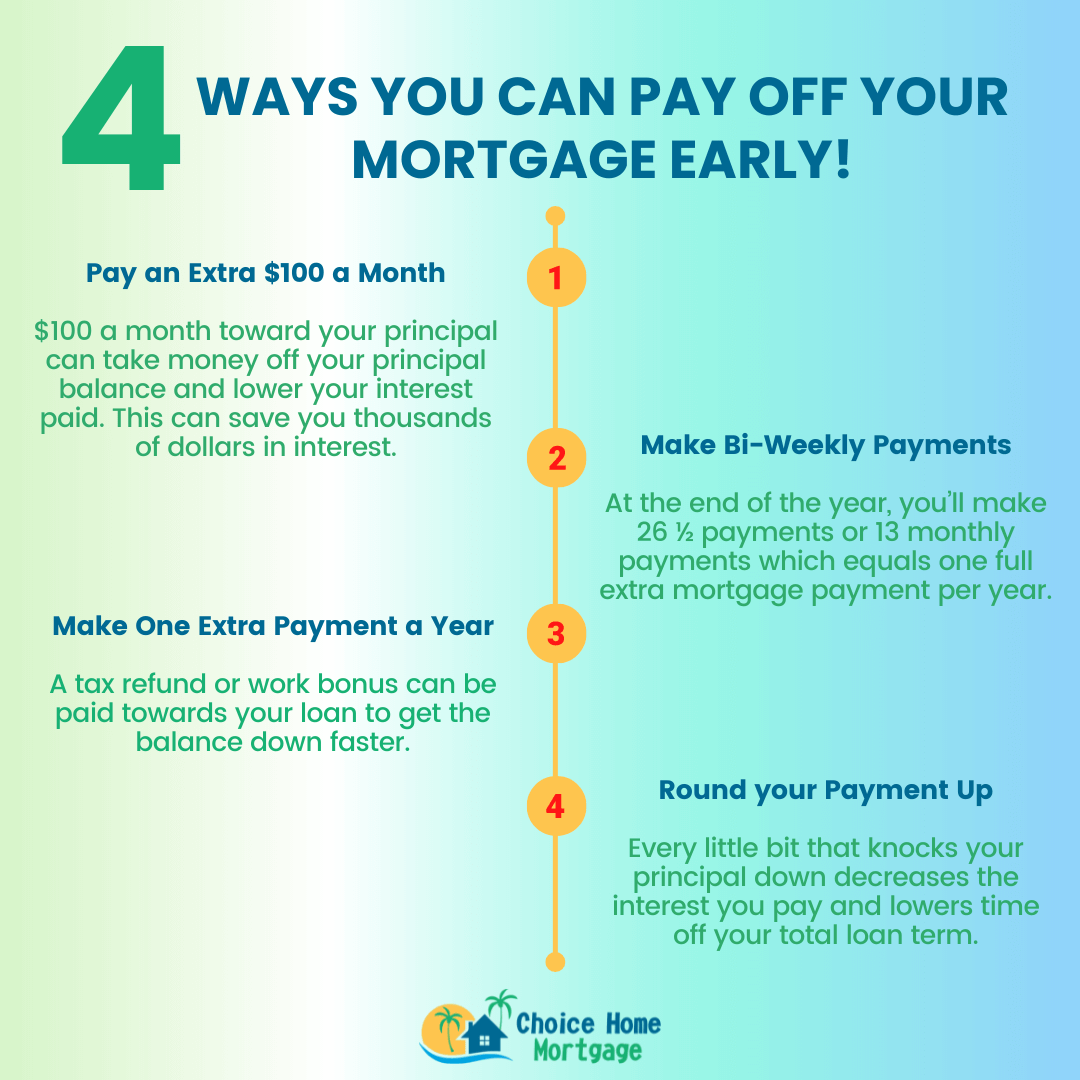

. Or you can do so at more frequent intervals during the year. Without letting your mortgage lender know that you want your extra payment to go toward reducing your principal loan balance he or she may think that youre simply paying your next mortgage bill early. Web Adding an Extra Mortgage Payment of 10 Per Month Even adding a nominal amount such as 5 or 10 On a monthly basis over a long period of time Can save you thousands of dollars on your mortgage And shorten your loan term at the same time Lets start with a simple scenario where you add just 10 a month in extra payment to.

Heres what you need to know about the potential tax savings. Web How to make an extra mortgage payment In general there are a handful of different ways to make extra mortgage payments and pay off your loan faster. Web You have high-interest debt.

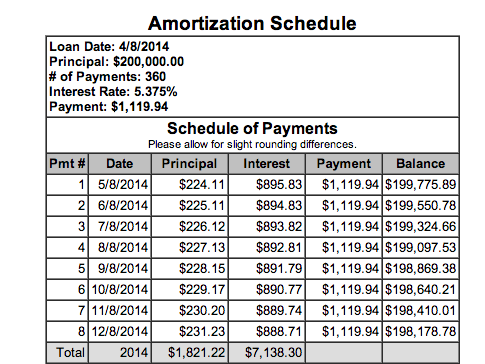

Web Your monthly payment is 96640. If you have a 200000 mortgage at 3 for 30 years biweekly payments will save. Web Even paying 20 or 50 extra each month can help you to pay down your mortgage faster.

Rather than make extra payments toward your mortgage principal consider paying down high-interest debt first. Web Adding just one extra payment a month will help you be mortgage-free sooner and save you potentially thousands in interest. Web The Tax Advantage of Making an Extra Mortgage Payment This Year SmartAsset You can make an extra mortgage payment at the end of the year to qualify for a tax break.

Web If you have a 300000 mortgage at 4 for 30 years biweekly payments will save you 35000 in interest payments. This can include credit card student loan medical and car loan debt just to name a few. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow.

If you add 200 to your monthly mortgage payment youd pay off the loan in 21½ years and save about 45000 in interest. Web A common question we get. Refinance to a lower rate.

You will pay 23313389 in interest over the course of the loan. This one boils down to a difference of simple dollars and cents. Web Paying extra on your mortgage means that you make additional payments to your principal loan balance beyond your regular payments.

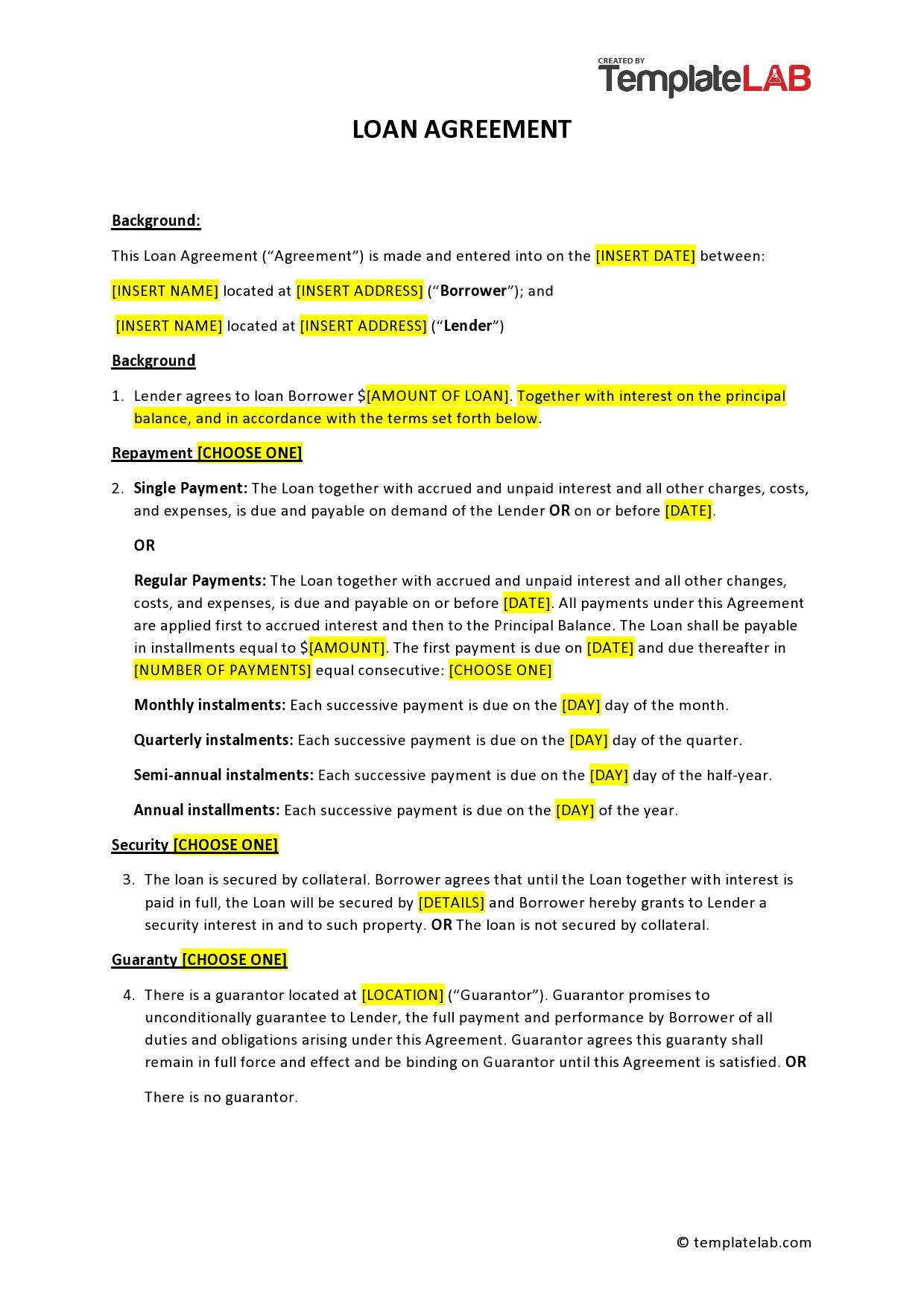

Web Lets say you owe 200000 on a 30-year loan with a 4 interest rate and you can afford to contribute an extra 200 toward either the mortgage or an investment account. Web Before you start making extra mortgage payments its important to speak with your lender. Thats in addition to the 200000 loan the principal that you have to repay.

No longer having a mortgage. Web As an example if you make an extra payment each year on your 250000 30-year mortgage at a rate of 34 you will save over 20000 in interest over the life of the loan. By paying an additional 100 per.

Web If paying extra on this loan means you wont be able to max out retirement accounts earn your full employer match on your 401 k or save for important big purchases then you probably. Eliminate your monthly mortgage payment and enjoy the additional cash flow. Should I make extra mortgage payments each month.

We analyzed a few scenarios in our latest post on the Doctor Money Digest. Add extra dollars to each monthly payment Make more frequent payments Apply a one-time lump sum payment Effects of making extra mortgage payments. Web Making extra mortgage payments may help reduce the term of your loan in addition to the amount of interest paid over the term of the loan.

If youre having a hard time with credit card debt like many Americans its more than likely you dont have enough. Calculating Your Potential Savings If you have a 30-year 250000 mortgage with a 5 percent interest rate you will pay 134205 each month in principal and interest alone. Pay off credit card debt.

Shorten the length of your mortgage Sending additional principal payments will shorten the life of your mortgage and build equity faster. Web You can make additional payments applied to your principal at the time your mortgage payment is normally due or earlier. The extra 10 years.

For example if you pay 1300 per month normally you may pay an extra 200 to the principal for a. However while making extra mortgage payments typically comes with benefits there are other things you may want to consider before doing so. If you pay half of your minimum payment with each payment youll always make your minimum monthly payment.

Web With biweekly mortgage payments you make a payment toward your mortgage every two weeks. Over the life of your loan you pay nearly 148000 in interest costs.

Should You Pay Off Your Mortgage Or Invest The Cash

![]()

Should You Pay Extra On Your Mortgage Interest Com

Public Service Loan Forgiveness Pslf Ultimate Guide

Pay It Plan It Features Come To Amex Green Gold And Platinum Cards

How Much Is A Down Payment On An Fha Loan Texas United Mortgage

Confessions Of A Forty Something F K Up By Alexandra Potter Goodreads

Cheap London Theatre Tickets Top Deals Available Mse

Xvpfm66lmhm0fm

Become A Mortgage Loan Originator 6 Step Guide

Is Prepaying Your Mortgage A Good Decision Bankrate

Canadian Mortgage App Apps On Google Play

The 50 Best Money Making Apps To Download Now

Simple Interest Rate Formula Calculator Excel Template

Should I Pay Off My Mortgage Early Or Not My Money Design

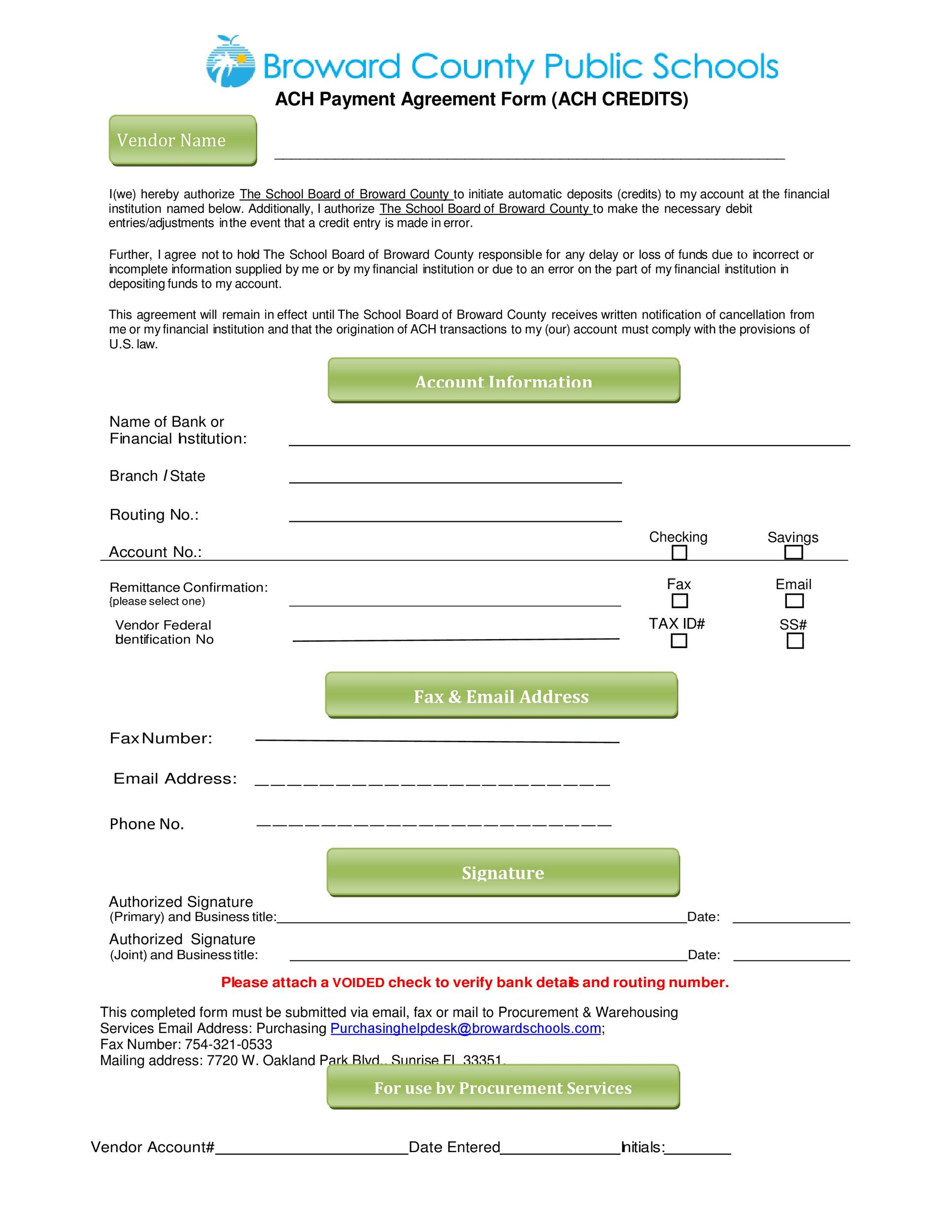

Payment Agreement 41 Templates Contracts ᐅ Templatelab

How Much Savings Should I Have By 40 A Retirement Savings Guide

Two Extra Mortgage Payments A Year Can Save You 64 000